The only state-owned bank in the country, the Bank of North Dakota (BND) has a mission to “promote agriculture, commerce, and industry” and “be helpful to and assist in the development of… financial institutions… within the State.”

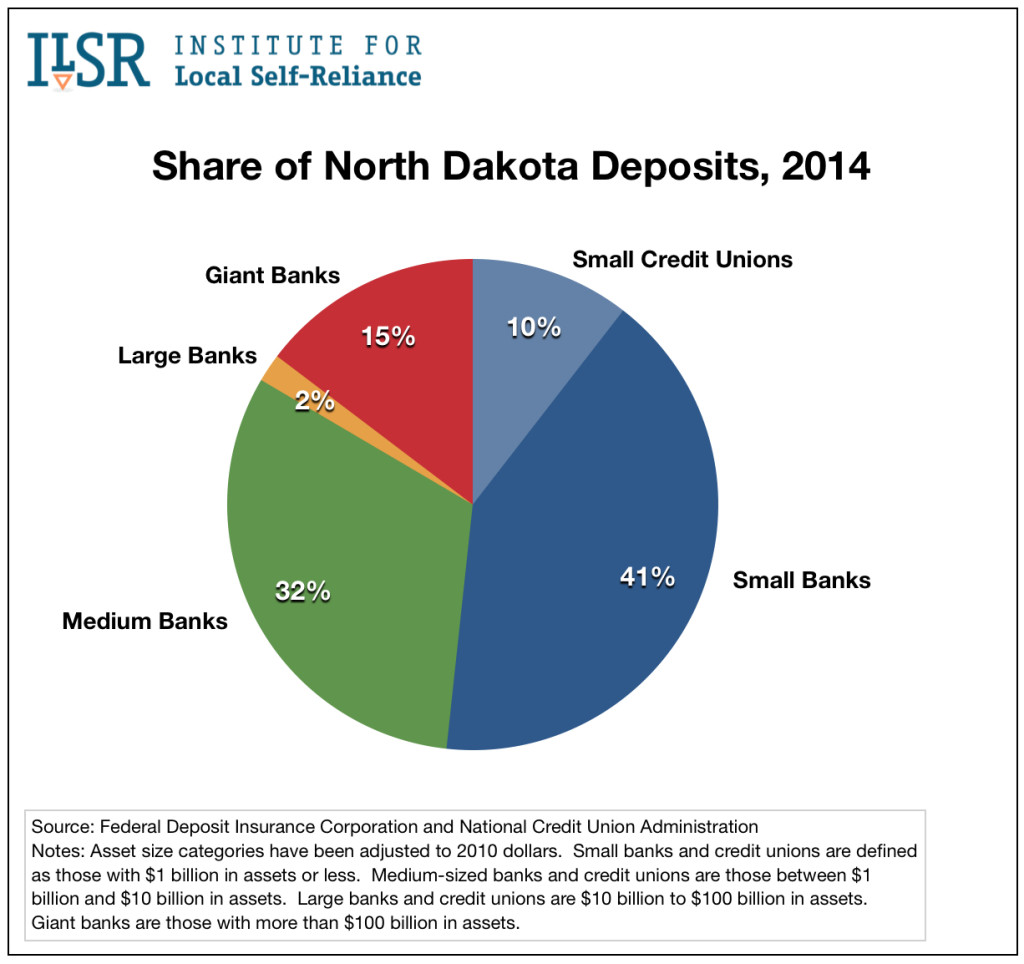

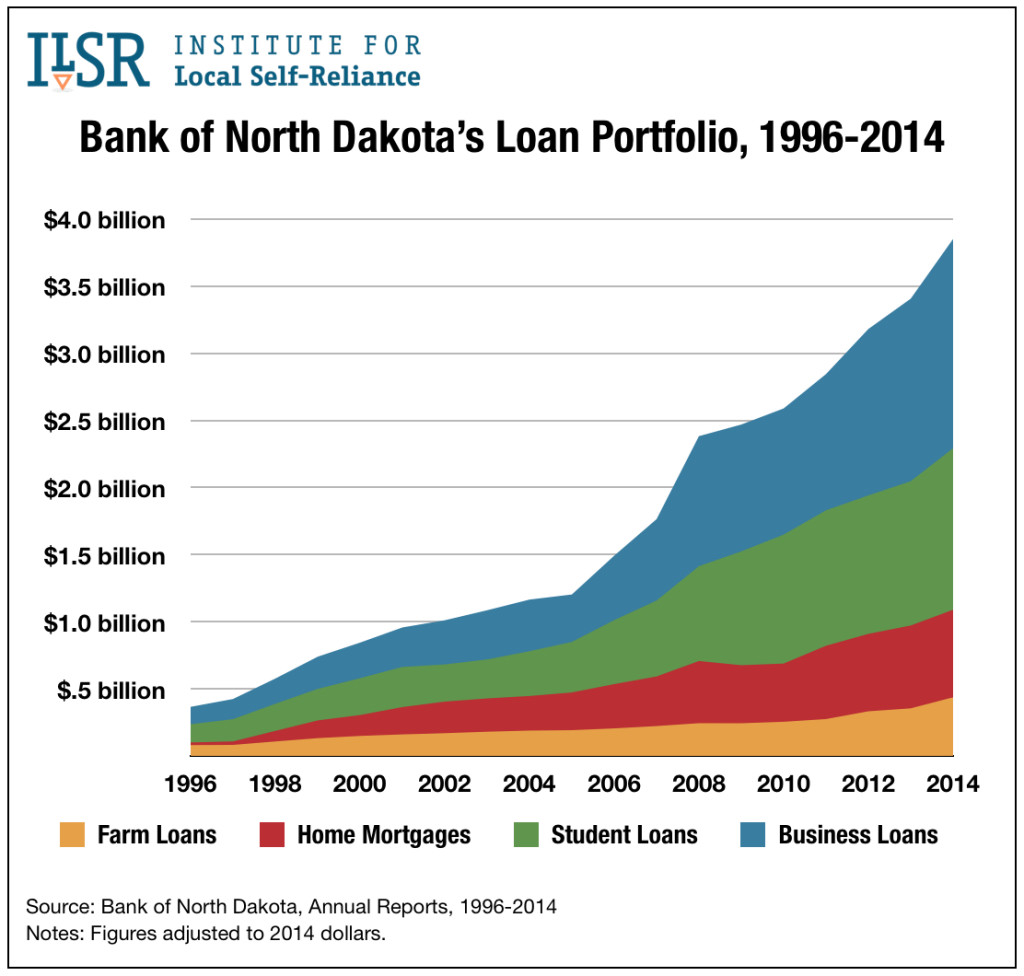

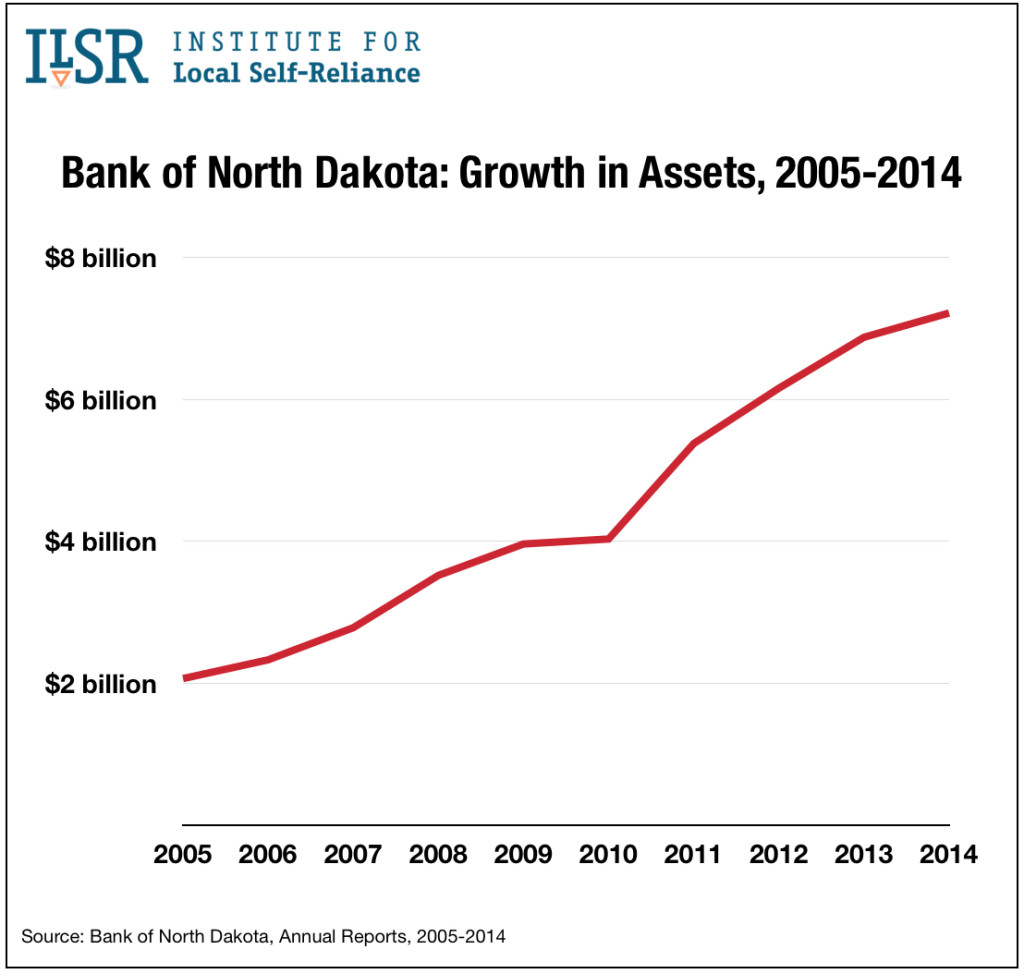

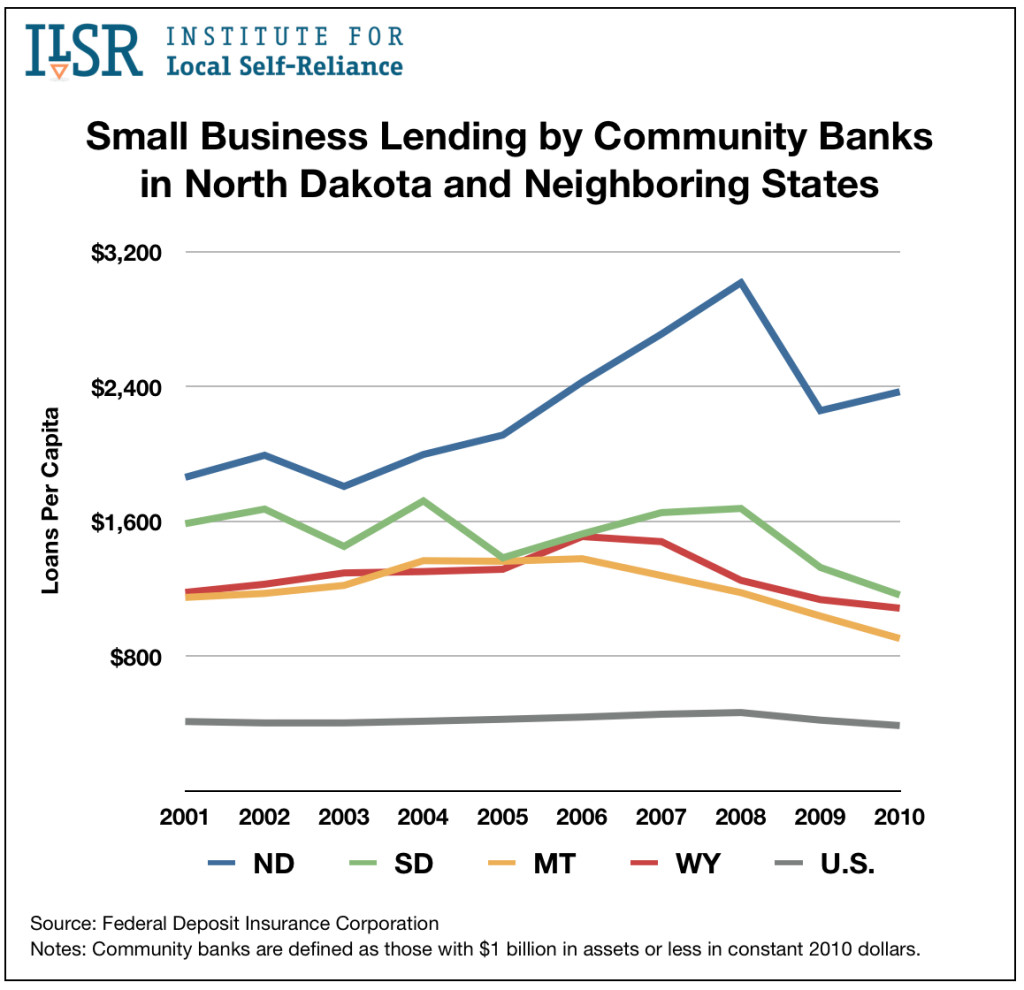

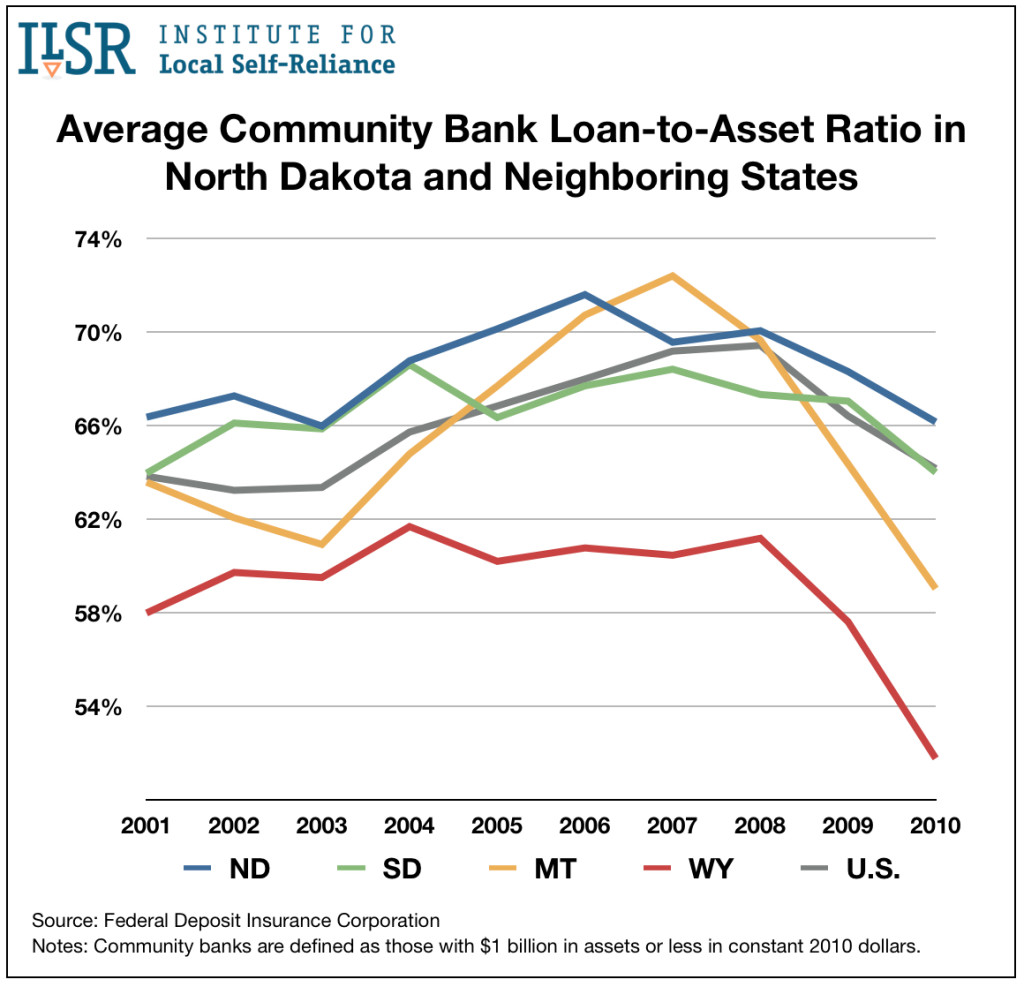

With a $3.9 billion lending portfolio (see graphs 3 and 4 below), BND is a significant source of financing in the state. Almost all of its business and agricultural loans are made in partnership with locally owned banks and credit unions, thus boosting the overall lending capacity of these community institutions and giving them added strength in competing against large out-of-state banks. In addition, BND buys mortgages and offers student loans at interest rates significantly lower than those available in other states.

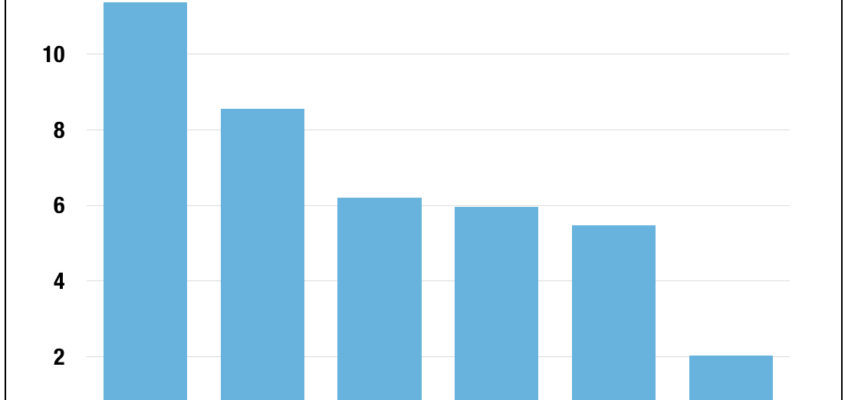

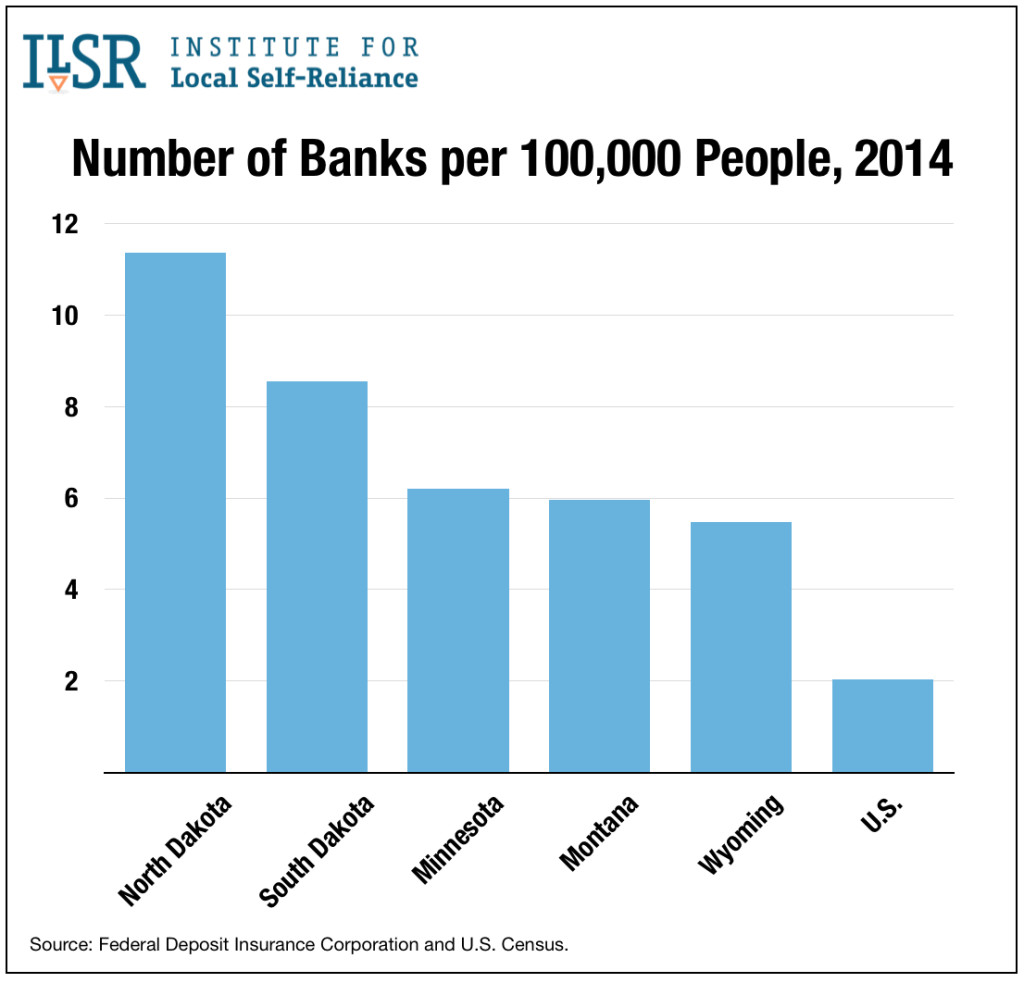

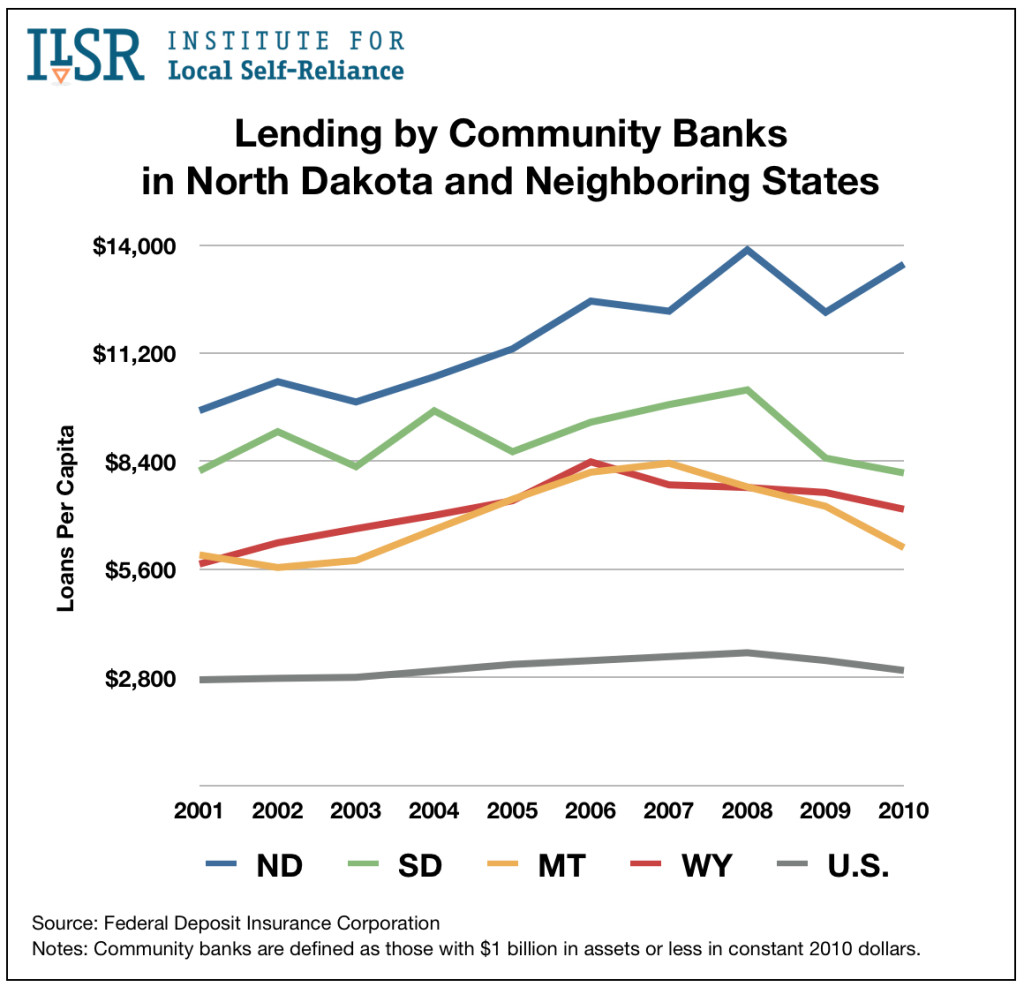

Thanks in large part to BND, community banks and credit unions are much more robust in North Dakota than in other states. The state has more local banks per capita than any other state. And, as the second graph below shows, small and medium-sized banks and credit unions — almost all of which are locally owned and headquartered in the state — hold 83 percent of the deposits in North Dakota. Nationally, small and medium-size banks and credit unions account for just 29 percent of the market, while giant banks control 58 percent.

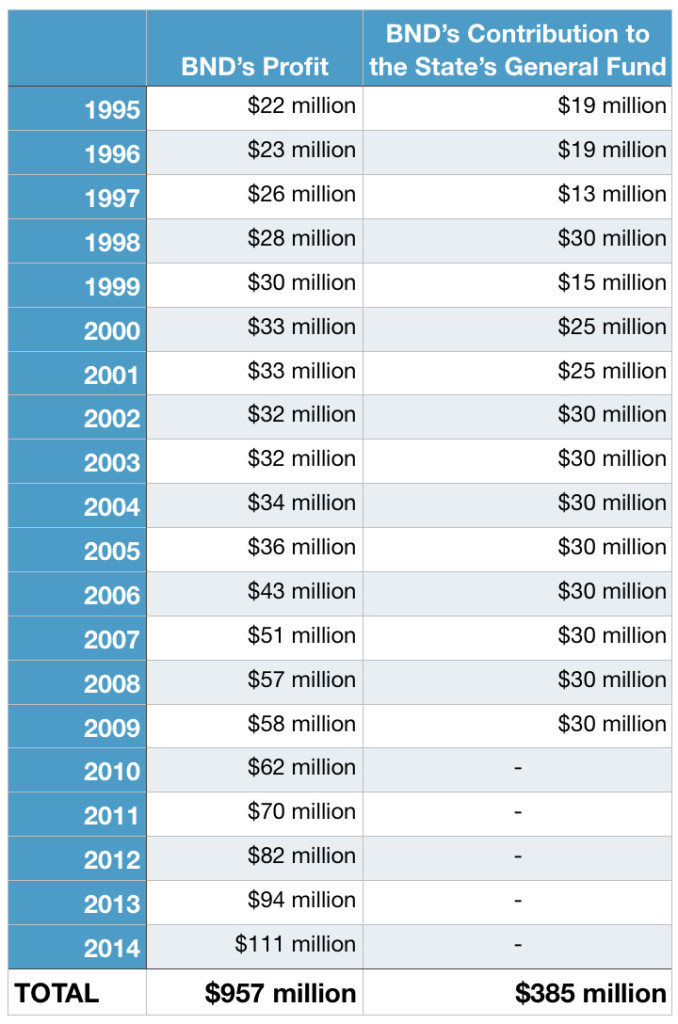

Over the last 21 years, BND has generated almost $1 billion in profit, with nearly $400 million of that, or about $3,300 per household, going into the state’s general fund to support education and other public services.

Learn more about the history, structure, and impact of the Bank of North Dakota.