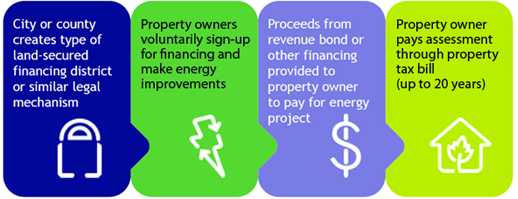

Yesterday Michigan governor Jennifer Granholm signed the state’s Property Assessed Clean Energy (PACE) law, making Michigan the 24th state to enable cities and counties to provide financing for on-site renewable energy and energy efficiency improvements via the property tax system. But it’s unclear how many municipalities will move ahead given the roadblocks facing residential PACE programs across the country.

Yesterday Michigan governor Jennifer Granholm signed the state’s Property Assessed Clean Energy (PACE) law, making Michigan the 24th state to enable cities and counties to provide financing for on-site renewable energy and energy efficiency improvements via the property tax system. But it’s unclear how many municipalities will move ahead given the roadblocks facing residential PACE programs across the country.

By mid-2010, just a handful of PACE programs had served nearly 2,000 properties with $40 million in renewable energy and energy efficiency projects, and dozens of municipalities were poised to launch their own programs. However, the residential PACE programs came to an abrupt halt when government-backed lenders Fannie Mae and Freddie Mac said they would refuse to purchase residential mortgages for properties that participated in the innovative financing program. PACE programs serving commercial property were unaffected by the lenders’ decision.

At this time, there are dim prospects for PACE financing to continue, most of which we detailed in an October post. The most promising is a set of lawsuits in federal court (case #4:2010-cv-03084), where many of cities and counties with early PACE programs have sued the lenders. The case is scheduled for a settlement conference in March 2011.

There was also legislation introduced in Congress to force the lenders’ hand, but it hasn’t moved in part because the Obama administration (via the Federal Housing Finance Agency and Comptroller of the Currency) have both supported the lenders’ intransigence, despite analysis suggesting that the program presented little threat to their solvency.

In the meantime, the Federal Housing Administration has launched the HUD PowerSaver, a pilot financing program for residential properties modeled on the Title I Property Improvement Loan Insurance program. It will assist homeowners in getting low-interest private bank financing for home retrofits or on-site renewable energy, but the credit restrictions on the program mean few homeowners who lack access to private financing will be able to participate. Also, unlike PACE the financing will be tied to the homeowner and not the property, creating the same problem for homeowners who might like to invest in efficiency but have plans to move within a few years.

Residential PACE programs may yet come back to life, but it seems that PowerSaver and other financing tools may be the only option for the foreseeable future.