North Dakota is the only state that has established a publicly owned bank. Founded in 1919, the Bank of North Dakota’s mission is to “promote agriculture, commerce, and industry” and “be helpful to and assist in the development of… financial institutions… within the State.”

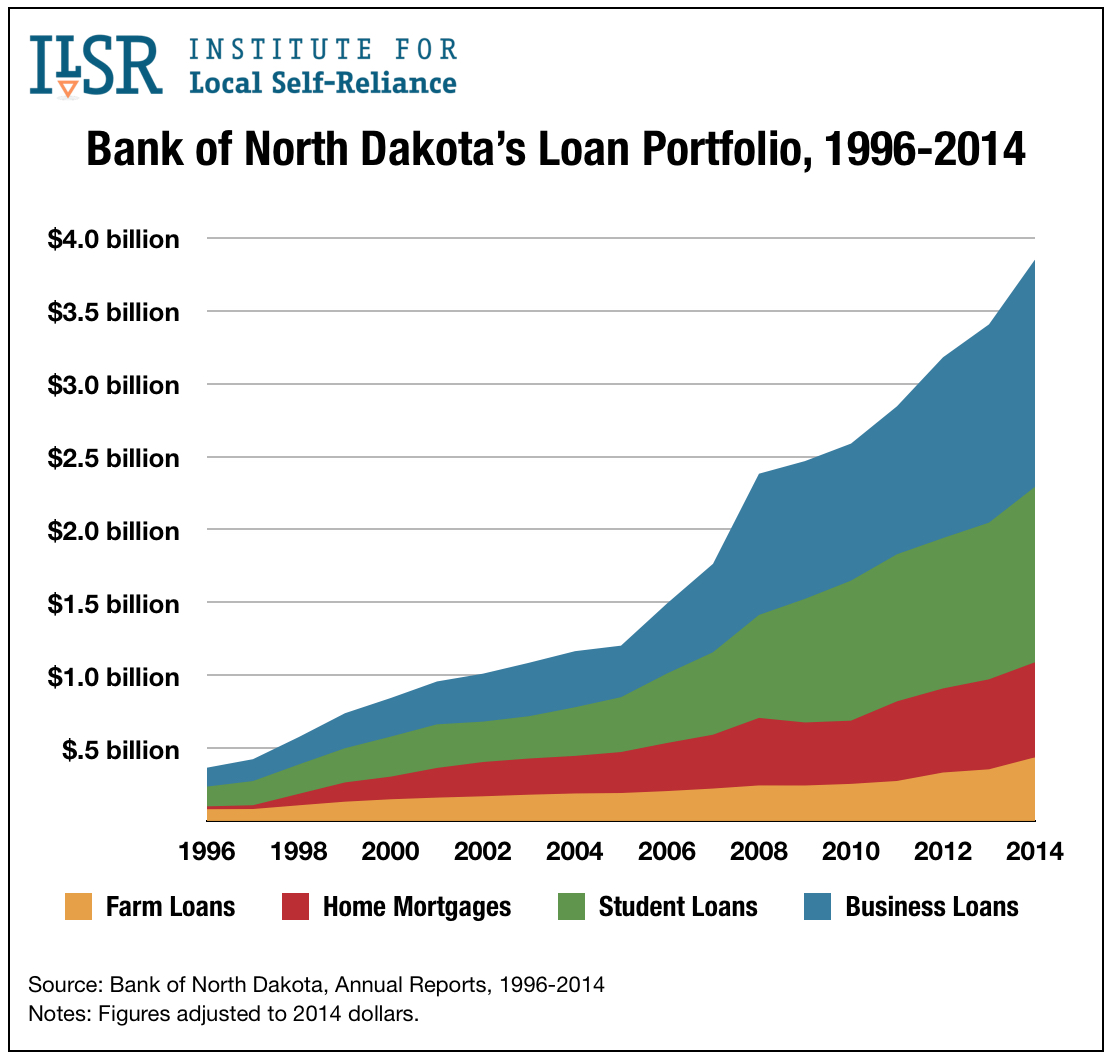

BND functions mainly as a “banker’s bank” — meaning that most of its lending is done in partnership with local banks and credit unions. About half of the bank’s $3.9 billion loan portfolio consists of business and agricultural loans that are originated by a local financial institution and funded in part by BND. By participating in these loans, BND expands the lending capacity of North Dakota’s community banks, giving them added strength in competing against big out-of-state banks.

BND functions mainly as a “banker’s bank” — meaning that most of its lending is done in partnership with local banks and credit unions. About half of the bank’s $3.9 billion loan portfolio consists of business and agricultural loans that are originated by a local financial institution and funded in part by BND. By participating in these loans, BND expands the lending capacity of North Dakota’s community banks, giving them added strength in competing against big out-of-state banks.

The remainder of BND’s loan portfolio consists of residential mortgages and student loans. In keeping with its mission to support, rather than compete with, local banks, BND does not make home loans directly. Instead, it provides a secondary market, buying up mortgages originated by the state’s local banks and credit unions.

Student loans are the only part of the bank’s lending in which it works directly with borrowers. At a time when many students leave college burdened by high-interest rate loans, BND offers some of the lowest student loan rates in the country.

Student loans are the only part of the bank’s lending in which it works directly with borrowers. At a time when many students leave college burdened by high-interest rate loans, BND offers some of the lowest student loan rates in the country.

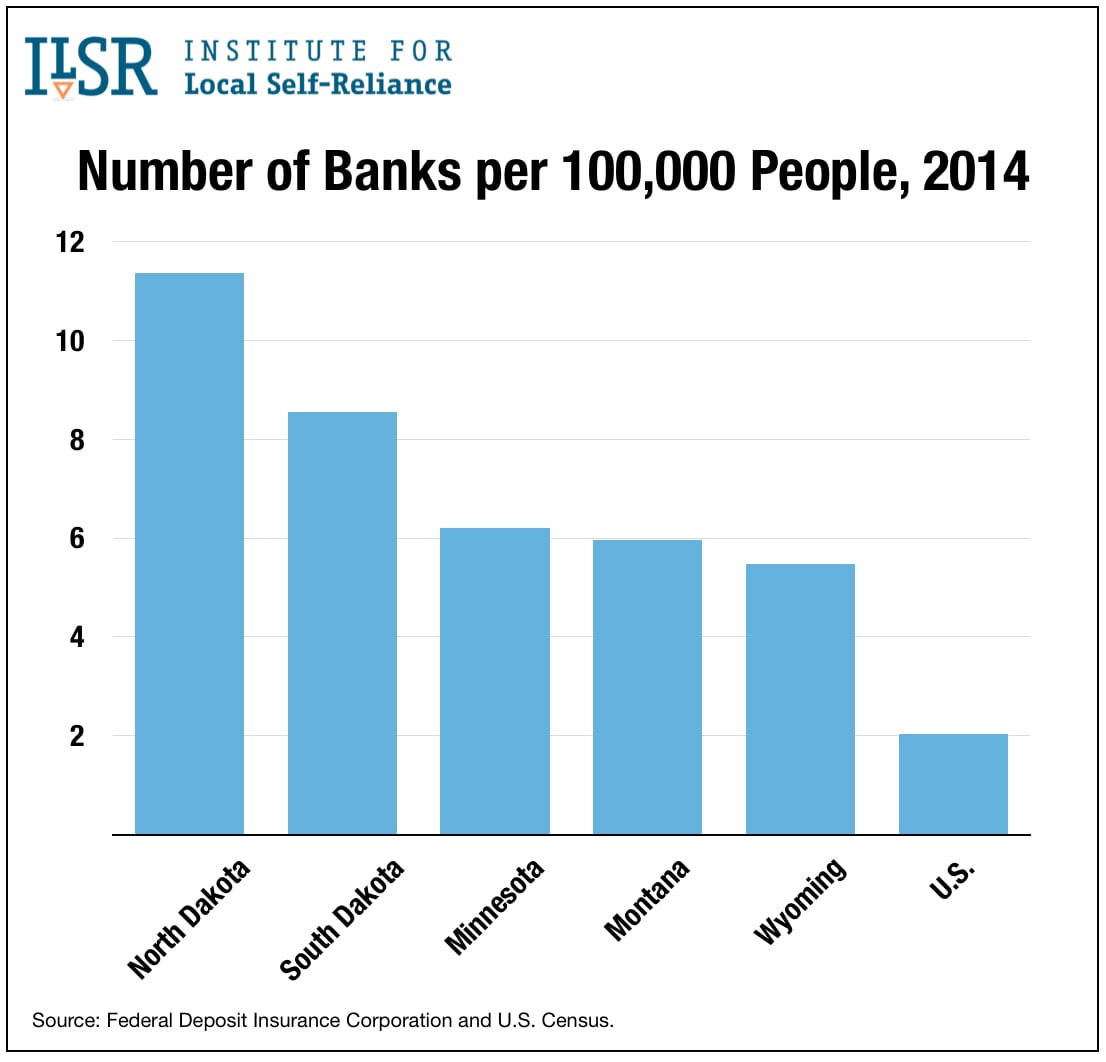

Thanks in large part to BND, community banks are much more numerous and robust in North Dakota than in other states. North Dakota has more banks and credit unions per capita than any other state. In fact, it has nearly six times as many local financial institutions per person as the country overall. While locally owned small and mid-sized banks and credit unions (those under $10 billion in assets) account for only 29 percent of deposits nationally (see this graph), in North Dakota they have a remarkable 83 percent of the market.

By helping to sustain a large number of local banks and credit unions, BND has strengthened North Dakota’s economy, enabled small businesses and farms grow, and spurred job creation in the state.

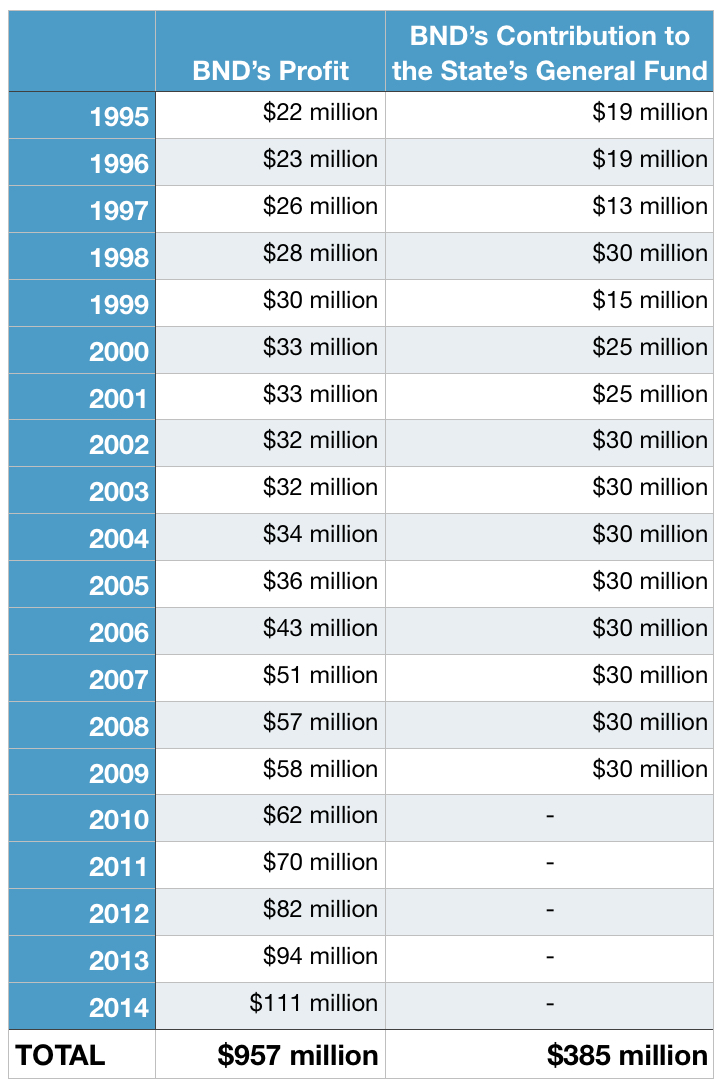

Over the last 21 years, BND has generated almost $1 billion in profit. Nearly $400 million of that, or about $3,300 per household, has been transferred into the state’s general fund, providing support for education and other public services, while reducing the tax burden on residents and businesses.

History and Structure

Desperately poor and tired of being at the mercy of out-of-state economic powers, North Dakota’s farmers launched the Nonpartisan League in 1915. This political party united progressives, reformers, and radicals behind a platform that called for returning control of the state’s economy to its people. At the time, farmers were utterly dependent on out-of-state grain milling companies, national railroads, and Minneapolis banks, all of which had been gouging farmers.

Desperately poor and tired of being at the mercy of out-of-state economic powers, North Dakota’s farmers launched the Nonpartisan League in 1915. This political party united progressives, reformers, and radicals behind a platform that called for returning control of the state’s economy to its people. At the time, farmers were utterly dependent on out-of-state grain milling companies, national railroads, and Minneapolis banks, all of which had been gouging farmers.

In the 1918 elections, the League won both houses of the legislature. One of the first bills these new lawmakers passed created a publicly owned grain mill, the North Dakota Mill and Elevator, and a publicly owned bank, the Bank of North Dakota (BND).

BND is governed by the state’s Industrial Commission, consisting of the governor, attorney general, and the commissioner of agriculture, all elected officials. The commission, in effect, serves as the bank’s board of directors. The bank also has a seven-member advisory board, which is appointed by the Governor and consists of people with expertise in banking, including representatives of community banks.

BND is governed by the state’s Industrial Commission, consisting of the governor, attorney general, and the commissioner of agriculture, all elected officials. The commission, in effect, serves as the bank’s board of directors. The bank also has a seven-member advisory board, which is appointed by the Governor and consists of people with expertise in banking, including representatives of community banks.

The primary deposit base of the BND is the State of North Dakota. All state funds and funds of state agencies (excluding pension funds and trusts managed by the state) are deposited with the bank. The bank pays a competitive interest rate that is generally at about the midpoint of rates paid by other banks in the state.

Individuals may also open accounts at the bank, but BND does not market these services and does not have ATMs, branch offices, and other standard features common to retail banks. This is in keeping with the bank’s mission to support local banks, rather than compete with them.

In contrast to most commercial banks, BND is not a member of the Federal Depository Insurance Corporation. Its deposits are instead guaranteed by the state of North Dakota.

Capitalizing the Local Economy

The core mission of the Bank of North Dakota is to cultivate the state’s economy by supporting local banks and credit unions. The more these community-based financial institutions flourish, the thinking goes, the more capacity they have for financing new and growing businesses. BND works with almost all of the state’s 89 local banks and many of its credit unions.

One of the chief ways BND fulfills this mission is through its lending. The bank’s $3.9 billion loan portfolio has four main components: business, farm, residential, and student loans.

One of the chief ways BND fulfills this mission is through its lending. The bank’s $3.9 billion loan portfolio has four main components: business, farm, residential, and student loans.

Its business and farm loans, which comprise half of its lending, are almost exclusively “participation” loans. These loans are originated by local banks and credit unions, but BND provides part of the funds. In doing so, BND expands the lending capacity of the state’s local financial system. At the end of 2014, BND had almost $2 billion in participation loans in its portfolio, an amount equal to 10 percent of the total value of loans outstanding on the books of the state’s small and mid-sized community banks and credit unions. This partnership helps local banks compete is by enabling them to make larger loans than they could on their own. As their business customers grow and require larger loans, North Dakota’s local banks, with the support of BND, can continue to meet their needs, rather than lose these borrowers to large out-of-state banks.

Another segment of BND’s portfolio is comprised of mortgages. About 20 years ago, the bank began buying home loans made by local banks and credit unions. At the time, local banks were looking for an alternative to the conventional secondary mortgage market. They no longer wanted to sell their home loans to Wells Fargo and other large banks, a practice that was giving their biggest competitors a steady stream of new customers. BND stepped in and offered to purchase their mortgages instead. This gave local banks a way to move loans off their books, thus freeing them up to make new loans, but without handing the business to their competitors.

This arrangement also benefits borrowers. First, BND services the mortgages it buys, ensuring that North Dakota homeowners continue to have in-state servicing for their loans. Second, it ensures that the mortgage interest homeowners pay each month stays in the state rather than flowing to Wall Street. In 2010, BND purchased about 7 percent of the home loans originated in the state. It currently holds about $650 million in residential mortgages. Between BND’s mortgages and those held by local banks and credit unions, roughly 20-25 percent of the state’s mortgage debt is held and serviced within North Dakota.

The final component of BND’s loan portfolio consists of student loans. This is the only area of lending in which the bank works directly with borrowers. BND offers loans to state residents enrolled in schools located anywhere, as well as to out-of-state residents attending schools in North Dakota or any adjacent state. Its interest rates are widely regarded as some of the lowest in the country. In early 2015, the bank’s rates were about 2 percent for a variable-rate loan and 5 percent for a fixed-rate — substantially lower than the 10-15 percent rates typical of private student loans. In April 2014, the bank launched a new program that allows residents to consolidate their student loan debt. By the end of the year, the bank had refinanced over $100 million in student loans, saving borrowers money by cutting their interest payments.

Backing Community Banks and Credit Unions

BND supports the state’s financial institutions in other ways as well. One of its explicit goals is to expand local ownership of banks and increase their capitalization. To this end, the bank has a bank stock loan program, which provides loans to finance the purchase of bank stock by North Dakota residents. In 2008, for example, BND provided a loan to help the employees of Ramsey National Bank & Trust in Devil’s Lake, North Dakota, gain a controlling interest in the bank, ensuring that this institution, which was founded in 1892 and has about $200 million in assets, would continue to be owned locally.

BND functions as a kind of mini Federal Reserve. It clears checks for both banks and credit unions, provides coin and currency, and maintains an Automated Clearing House system that allows local banks to offer direct deposit and automated payment services to their customers. Its Federal Funds program assists local banks with short-term liquidity needs and has a daily volume of over $300 million.

The state bank also enables North Dakota’s local banks to take deposits and manage funds for municipal and county governments. This is rare in other states, because banks must meet fairly onerous collateral requirements in order to accept public deposits. This can make taking public funds more costly than it’s worth. But in North Dakota, those collateral requirements are waived by a letter of credit from BND. This gives local banks an additional source of deposits and benefits residents by ensuring that their city and county funds are held locally rather than turned over to distant Wall Street banks.

In tough economic times, BND helps stabilize North Dakota’s banking system. During the aftermath of the recent financial meltdown, as community banks in other states struggled to retain sufficient capital levels as many of the loans on their books went unpaid — a balance-sheet crisis that caused a staggering number to fail — North Dakota’s banks turned to BND. The state bank helped them increase their capital ratios by buying loans on their books and infusing them with new equity investment through its bank stock loan program.

Federal data show that North Dakota’s local banks are healthier than their peers. They are more efficient, devote more of their resources to productive lending, and earn better returns on their assets than community banks nationally.

Impact of the Bank of North Dakota

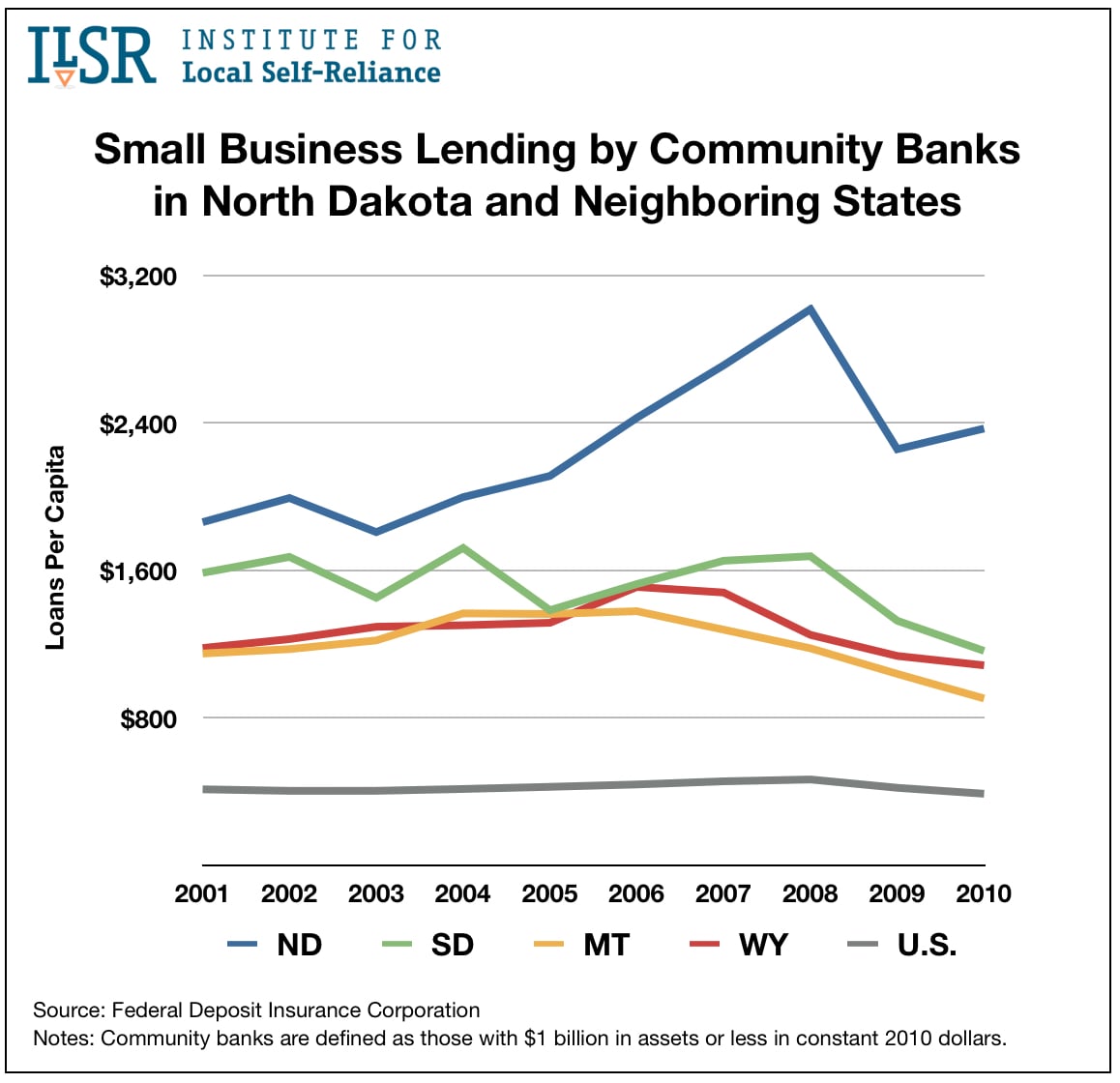

BND has helped North Dakota maintain a local banking sector that is markedly more robust than that of other states. North Dakota has more local banks (relative to population) than any other state. Over the last ten years, the amount of lending per capita by small community banks (those under $1 billion in assets) in North Dakota has averaged about $12,000, compared to $9,000 in South Dakota and $3,000 nationally. The gap is even greater for small business lending. North Dakota community banks averaged 49 percent more lending for small businesses over the last decade than those in South Dakota and 434 percent more than the national average. (To see graphs of these measures and others, go here.)

BND has helped North Dakota maintain a local banking sector that is markedly more robust than that of other states. North Dakota has more local banks (relative to population) than any other state. Over the last ten years, the amount of lending per capita by small community banks (those under $1 billion in assets) in North Dakota has averaged about $12,000, compared to $9,000 in South Dakota and $3,000 nationally. The gap is even greater for small business lending. North Dakota community banks averaged 49 percent more lending for small businesses over the last decade than those in South Dakota and 434 percent more than the national average. (To see graphs of these measures and others, go here.)

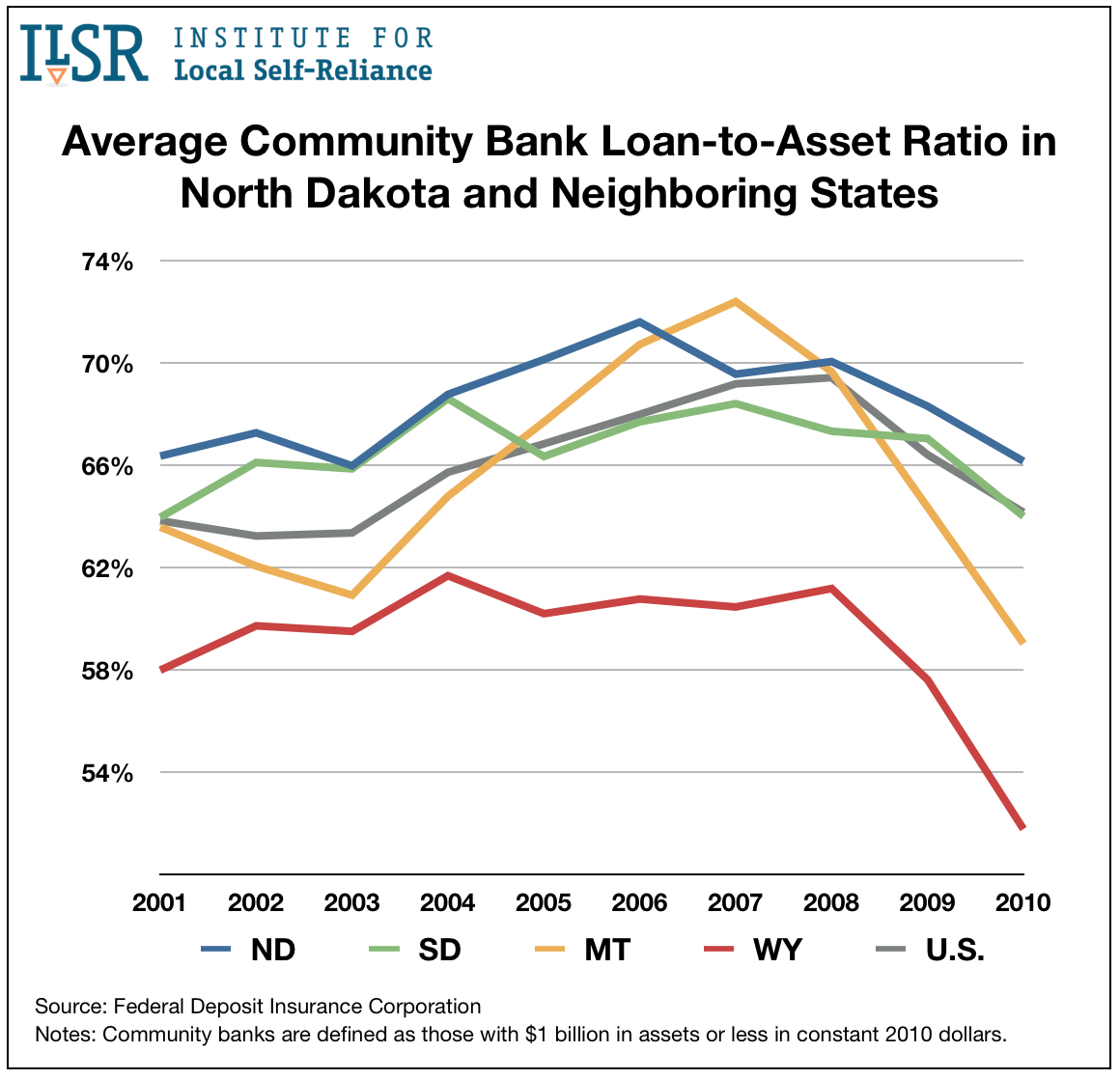

Not only are community banks more numerous and more active in North Dakota, but there is some indication that the Bank of North Dakota has enabled them to maintain a higher average loan-to-asset ratio — meaning they are able to devote more of their assets to economically productive lending, rather than safer holdings like U.S. government securities. North Dakota’s community banks have generally maintained a higher average loan-to-asset ratio than their counterparts in four neighboring states and nationwide. That ratio also declined much less steeply during the recession.

Not only are community banks more numerous and more active in North Dakota, but there is some indication that the Bank of North Dakota has enabled them to maintain a higher average loan-to-asset ratio — meaning they are able to devote more of their assets to economically productive lending, rather than safer holdings like U.S. government securities. North Dakota’s community banks have generally maintained a higher average loan-to-asset ratio than their counterparts in four neighboring states and nationwide. That ratio also declined much less steeply during the recession.

Expanding Economic Opportunity

By and large, BND is run on a for-profit basis. The bank evaluates loan opportunities according to how likely they are to be repaid and provide a return for BND. As the bank’s president and chief executive, Eric Hardmeyer, said in an interview with American Banker magazine, “If you are going to have a state-owned bank, you have to staff it with bankers. If you staff it with economic developers you are going to have a very short-lived, very expensive experiment. Economic developers have never seen a deal they didn’t like. We deal with that every day.”

BND does forego some profit, however, in order to further economic development in the state. The bank offers several programs that accept higher levels of risk or lower returns on certain kinds of loans. Through its PACE Fund (“Partnership in Assisting Community Expansion”), for example, BND buys down the interest rate by 1-5 percent for some job-creating business loans. In 2009, this program saved business borrowers $3.5 million in interest payments. BND makes about 50 of these loans a year (all in partnership with a community bank and a local economic development entity) and currently has about 300 outstanding, valued at $50 million. BND operates a similar program for farmers called Ag PACE.

BND also has a Business Development Loan Program, which enables new and existing businesses to obtain loans that have a higher degree of risk than would normally be acceptable to a lending institution, while its Beginning Entrepreneur Loan Guarantee Program guarantees 85 percent of a loan of up to $100,000 made by a local bank to a start-up entrepreneur.

Profitability and Returns for the State

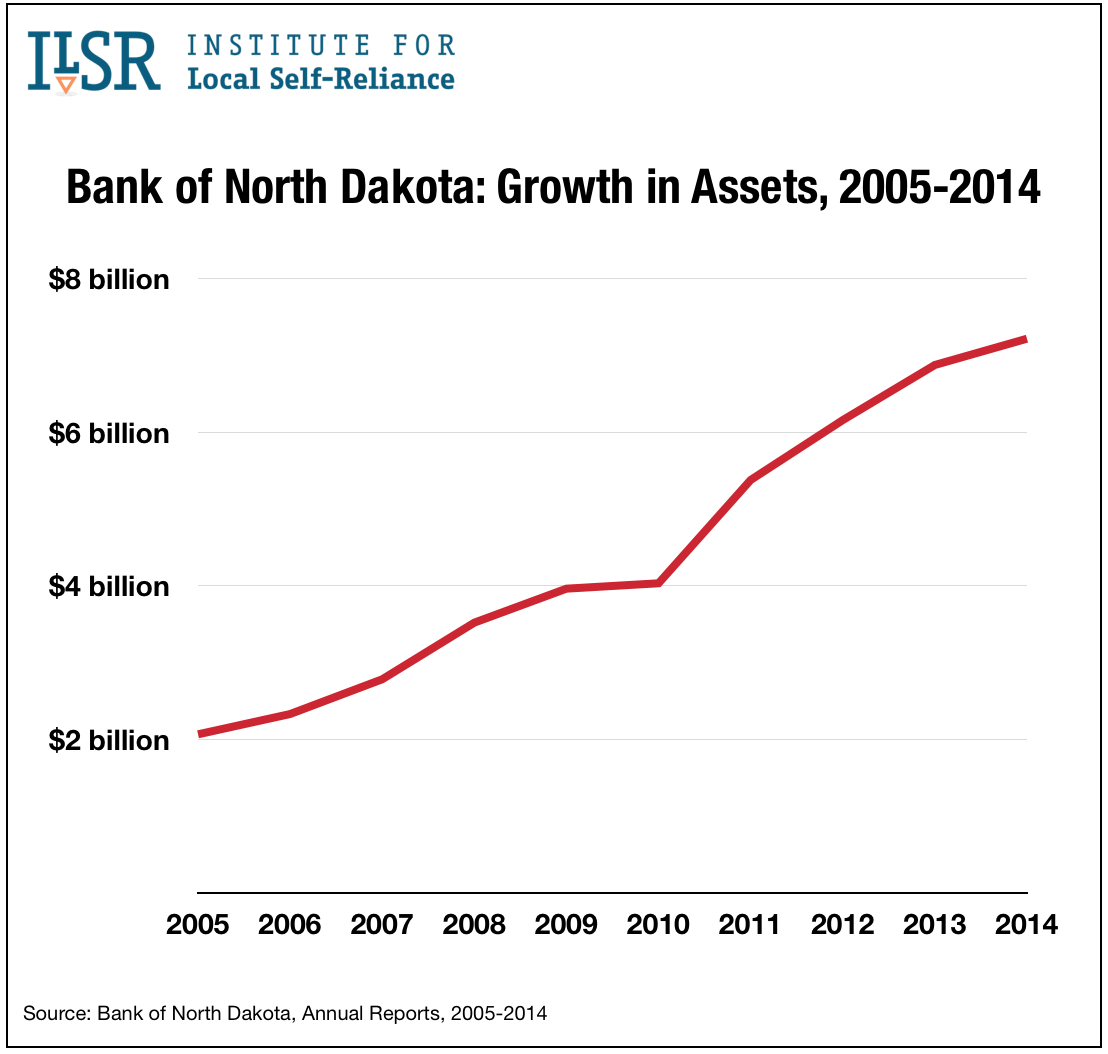

At the of end of 2014, the Bank of North Dakota had $652 million in capital and $7.2 billion in assets. The bank has grown substantially over the last two decades. Its assets have expanded sevenfold, and its net income, or profit, rose from $22 million in 1995 to $111 million in 2014.

At the of end of 2014, the Bank of North Dakota had $652 million in capital and $7.2 billion in assets. The bank has grown substantially over the last two decades. Its assets have expanded sevenfold, and its net income, or profit, rose from $22 million in 1995 to $111 million in 2014.

Although BND has foregone some profit in order to expand credit and lower the cost of loans for borrowers in North Dakota, the bank still earns a very healthy return on its assets. BND’s ROA, or return-on-assets, a standard measure of bank performance, was 1.54 percent in 2014, compared to an average ROA of 1.01 percent for all banks nationwide.

Part of the bank’s profits are used to expand its capital base, which in turn enables it to make more loans. The rest are paid into the state government’s general fund, reducing the amount of tax revenue the state needs to collect. How much of each year’s earnings are transferred to the state is determined through negotiations between the legislature and the bank’s Governing Board. Over the last 20 years, BND has made $385 million in payments to the general fund. That works out to about $3,300 per family — meaning North Dakota households received $3,300 more in public services than they had to pay for through taxes.

Part of the bank’s profits are used to expand its capital base, which in turn enables it to make more loans. The rest are paid into the state government’s general fund, reducing the amount of tax revenue the state needs to collect. How much of each year’s earnings are transferred to the state is determined through negotiations between the legislature and the bank’s Governing Board. Over the last 20 years, BND has made $385 million in payments to the general fund. That works out to about $3,300 per family — meaning North Dakota households received $3,300 more in public services than they had to pay for through taxes.

BND provides other direct financial benefits to the state. It can borrow at the Federal Reserve’s discount window, for example, and lend directly to local governments at lower rates than the municipal bond market provides.

BND can also provide emergency financing that would otherwise have to be shouldered solely by state and local government. When the Red River valley underwent massive flooding in 1997, BND quickly established a $25 million line of credit for the City of Grand Forks, $12 million for the University of North Dakota in Grand Forks, and $25 million for state emergency management. It also set up a disaster relief loan program for families and businesses. Partly as result of this support, the Grand Forks economy recovered much more quickly than its sister city of East Grand Forks just across the river in Minnesota.

More:

- Video: Bank of North Dakota

This 26-minute video, produced by Prairie Public Broadcasting, chronicles the bank’s history and current operations.

- North Dakota State Statutes

See sections beginning at 6-09 for the portion of the code that establishes the bank and governs its operations.

- Policy of the Bank of North Dakota

Adopted in 1920, sets out the mission and purpose of the bank.

- Testimony from Stacy Mitchell before the Maryland House of Delegates Economic Matters Committee on HB0794 [PDF], a bill to authorize a task force on public banking, February 2016